We have never seen so much global wealth destruction happen at once. Global equity markets are off in the 50 percent range and don’t seem to be letting up. We are seeing wealth destruction at an unprecedented rate. We can debate whether inflation will show up but until the U.S. Treasury bubble pops, we can expect to see deflation in our current forecast. I think it is hard for many to comprehend that $40 trillion has evaporated from a few niche markets.

In this article I’m going to focus only on 3 areas and find $40 trillion of wealth that is now gone. Keep in mind that this figure is not all encompassing. Recent estimates put global wealth destruction upwards of $70 trillion. So where is this $40 trillion? Let us first look at global equity markets:

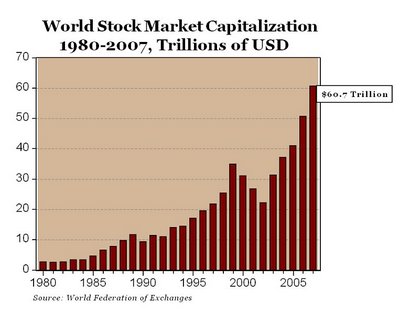

Global Stock Market Cap Value at Peak: $60.7 trillion

Current Global Stock Market Cap Value: $30 trillion (approximate)

At the peak the global stock market value in 2007 hit a peak of $60.7 trillion. Of course this was an epic bubble but the market was not reacting that way in 2007. The fact that most markets are off approximately 50 percent, would now put the global equity markets back to $30 trillion, a level unseen since 1999. The world it would seem has just witnessed a lost decade occur over one year.

Now keep in mind this varies. Here are a few baramoteres:

MSCI World Index: -50.1% from high

MSCI Emerging Markets Index: -60.4% from high

S & P 500: -47% from high

Hang Seng Index: -58% from high

Russia Trading System Index: -67.4% from high

Dublin ISEQ Index: -76.8% from high

Bombay Sensex Index: -54.9% from high

I think you get the picture. So right here alone, we have found our first $30.7 trillion in wealth destruction.

Running total: $30.7 Trillion

That is merely looking at global stock markets. But what about global real estate? We all know that there were multiple housing bubbles going on at the same time globally as everyone believed in the housing mania that swept the globe. From Dublin, to Sydney, to London, to Madrid, to New York, to Los Angeles, every major city seemed to be engulfed in this same housing delusion.

*Source: The Economist

In fact, as it turns out the United States did not have the most outrageous housing prices which is really saying something considering the seed of our bubble was planted way back in the early 1980s.

Countries like Ireland and Britain are in worse shape when it comes to real estate values. But let us only look at U.S. residential real estate values. First, at the peak residential real estate values were estimated to be at $24 trillion. If we look at the Case-Shiller Index we are now off by 25% from the peak. So let us do that math now:

U.S. Residential Real Estate at Peak: $24 trillion

Current U.S. Residential Value: $18 trillion

We’ve just found another $6 trillion gone but recent estimates are saying that American households have lost $7 trillion in real estate wealth. We’ll be generous and say $6 trillion. Keep in mind that we are only counting U.S. residential real estate. We didn’t even look at U.S. commercial real estate which is now imploding. In fact, I recently argued that the FDIC was ill equipped to handle the oncoming tsunami of

No comments:

Post a Comment